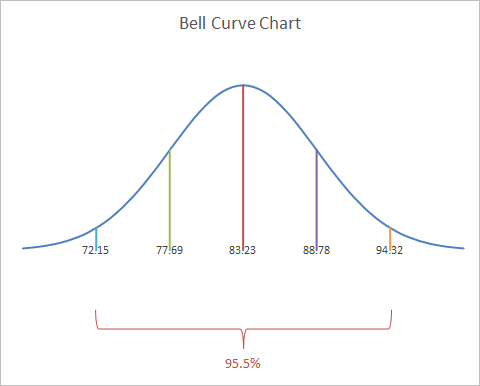

Income growth only results in an individual paying a higher marginal tax rate if their income is pushed into the next tax bracket. An individual with $1 million in taxable income, for instance, will pay an average tax rate of 42 per cent, reflecting that more than 80 per cent of their income is taxed at the highest rate of 45 per cent. Note: Excludes levies and offsets for illustrative purposes.įor taxable incomes well beyond the highest tax threshold of $180,000, the average tax rate gradually converges to the highest marginal tax rate of 45 per cent. 4įigure 1: Marginal tax rates exceed average rates in Australia’s tax system Marginal and average tax rates would only be the same in a system that applied a flat rate of tax to all income. Box 1 shows such an example.įigure 1 shows that the marginal tax rate is higher than the average tax rate in 2021‑22 at all income levels where tax is greater than zero. The ‘bracket structure’ of Australia’s personal tax system means that two individuals on very different incomes can face the same marginal tax rate yet face very different average tax rates. Taxable income is the measure of income used to calculate how much tax an individual needs to pay, which may be less than an individual’s gross income if, for example, deductions can be made. This differs from the average tax rate, which is an individual’s total tax as a proportion of their total taxable income. There are two important concepts to understand here – marginal tax rates and average tax rates.Īs outlined in the example above, an individual’s marginal tax rate is the amount of tax they would pay on an additional dollar of income they earn – if an individual’s marginal tax rate is 37 per cent and they earn one more dollar, they would pay an additional 37 cents of tax. This results in a total tax of just over $40,000, around 27 per cent of their total income (the average tax rate). Someone with an income of $150,000, for example, will pay no tax on their first $18,200, 19 per cent tax on the next $26,800, 32.5 per cent on the next $75,000, and finally 37 per cent on the last $30,000 (the marginal tax rate).

The range of income between two thresholds is called a ‘tax bracket’, and a higher tax rate applies to individuals as their income moves into the higher tax brackets. 3Īustralia’s personal tax system has four tax thresholds for the 2021-22 year.

As a result, an individual with an income of $40,000 in 2021‑22 (just above the current full-time minimum wage) pays no tax on their first $18,200, and 19 per cent tax on their next $21,800, around $4,000 in total, or 10 per cent of their income. For example, in Australia, a resident individual does not pay tax on their income up to the ‘tax‑free threshold’, currently $18,200, but only on income that exceeds this amount. Progressive tax systems are usually implemented through several tax brackets with increasing rates. These regular changes have kept the overall average personal income tax rate varying between 22 and 25 per cent of income for most of the past forty years. Outside periods of budget repair, governments have periodically increased tax thresholds or lowered tax rates, with the effect of reducing or even reversing the impact of bracket creep – this is referred to as ‘returning’ bracket creep.

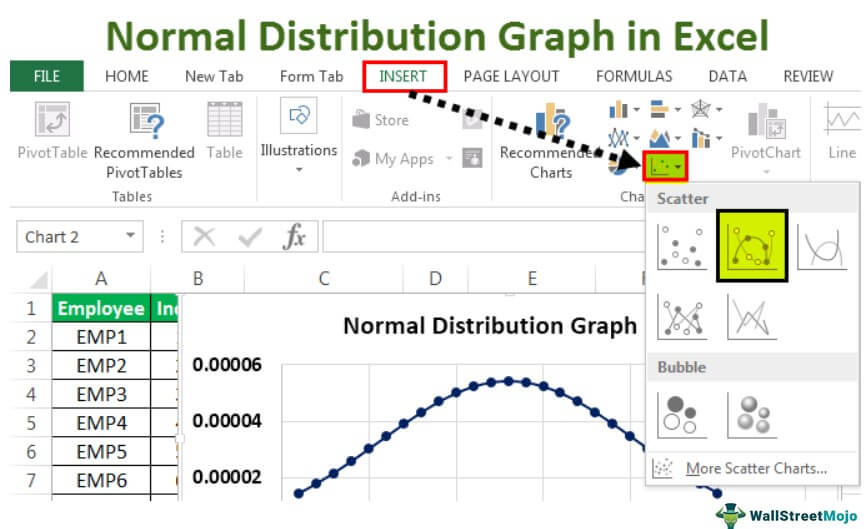

#Excel high low average plot driver

1 With Australia’s net debt expected to peak at 40.9 per cent of GDP ($981 billion) by the end of 2024‑25, personal income tax receipts, driven by bracket creep, are likely to be a major driver in reducing the debt-to-GDP ratio over the medium and long term. Bracket creep causes tax receipts to grow faster than the economy, which is sometimes known as ‘fiscal drag’.īracket creep has often played an important role in repairing the budget after a major downturn – bringing the budget back into surplus or reducing government debt. Many may be familiar with the experience of bracket creep as individuals, but few may have considered its significance for how governments manage their finances.

There are two reasons why bracket creep occurs in Australia: we have a progressive personal income tax system – where the proportion of income paid in tax gets higher as incomes get higher – and we have an economy where average incomes are usually increasing. Bracket creep occurs when rising incomes cause individuals to pay an increasing proportion of their income in tax, even though there may not have been changes to tax rates and thresholds.

0 kommentar(er)

0 kommentar(er)